Justification Statement for 1513-0030 Non-significant Change

1513-0030 (TTB F 5620.8) Non-significant Change Justification Statement.docx

Claim--Alcohol, Tobacco, and Firearms Taxes

Justification Statement for 1513-0030 Non-significant Change

OMB: 1513-0030

August 11, 2025

Non-substantive Change Justification Statement for

OMB Control Number 1513–0030, Claim—Alcohol, Tobacco, and Firearms Taxes

The Internal Revenue Code of 1986 (IRC) at 26 U.S.C. 5008, 5044, 5056, 5064, 5370, 5705, and 5708 authorizes claims for relief of Federal excise taxes on distilled spirits, wine, beer, tobacco products, and cigarette papers and tubes that were condemned, destroyed, lost or made unmarketable due to disaster, theft or vandalism, or that were voluntarily destroyed, returned to bond or withdrawn from the market. The IRC at 26 U.S.C. 5055, 5062, and 5706 also provides for drawback (refund) of taxes paid on such products subsequently exported outside of the United States. Additionally, the IRC at 26 U.S.C. 5111–5114, authorizes drawback (refund) of a portion of taxes paid on distilled spirits used in the manufacture of certain nonbeverage products, while 26 U.S.C. 5373(b)(3) allows credit for excise taxes on wine spirits removed from a distilled spirits plant and used in the production of wine. Additionally, under the IRC at 26 U.S.C. 6402–6404, taxpayers may file relief claims for erroneous, excessive, or overpaid excise or special occupational taxes, while 26 U.S.C. 6416 allows for credit or refund of overpaid firearms and ammunition taxes and 26 U.S.C. 6423 sets conditions on claims for erroneously collected alcohol and tobacco excise taxes. Under those various IRC sections, claimants generally must submit their claims within 6 months of the relevant action in the form and manner that the Secretary of the Treasury prescribes by regulation.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) administers chapter 51 (distilled spirits, wines, and beer), chapter 52 (tobacco products, processed tobacco, and cigarette papers and tubes), and sections 4181–4182 (firearms and ammunition excise taxes) of the Internal Revenue Code of 1986 (IRC), as amended (26 U.S.C.). TTB administers those IRC provisions pursuant to section 1111(d) of the Homeland Security Act of 2002, as codified at 6 U.S.C. 531(d). The Secretary of the Treasury also has delegated certain IRC administrative and enforcement authorities to TTB through Treasury Order 120–01.

Specific to this information collection, approved under OMB control number 1513–0030, TTB has issued various regulations in 27 CFR chapter I under its IRC and delegated authorities, regarding claims for relief of the excise taxes it collects. Those regulations generally require respondents to file their claims using form TTB F 5620.8, Claim—Alcohol, Tobacco, and Firearms Taxes. The form, and any required supporting documentation, identifies the claimant, the regulatory section the claim is made under, the type of claim and its basis, the kind and amount of tax claimed, and, if relevant, account information for the deposit of refunded tax.1

On March 25, 2025, the President issued an Executive Order, “Modernizing Payments To and From America’s Bank Account,” which was published in the Federal Register as E.O. 14247 on March 28, 2025, at 90 FR 14001. As a cost-saving and theft-prevention measure, the Executive Order requires, in general, that the Secretary of the Treasury cease issuing paper checks for all Federal disbursements, benefit payments, vendor payments, and tax refunds, and to make such payments via direct deposit or other electronic methods, effective September 30, 2025.

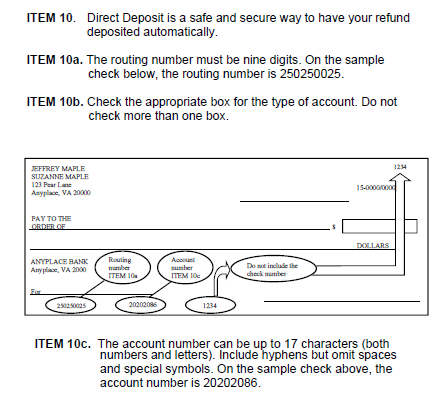

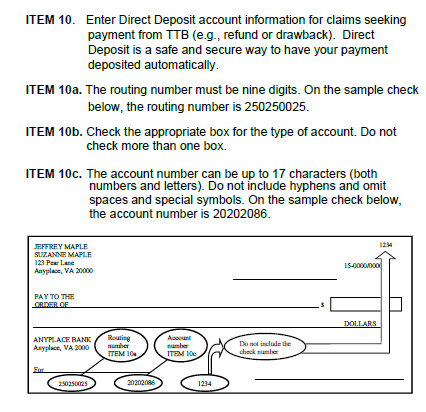

In response to E.O. 14247, on form TTB F 5620.8, TTB is making minor changes to Item 10 and its related instructions to require respondents to provide direct deposit information for claims made seeking payment from TTB (e.g. refund or drawback of tax). For claims involving drawback or refund of tax, Item 10 previously displayed a parenthetical note that Direct Deposit was optional. Item 10 will now display a note that Direct Deposit is “for refund/drawback.” This eliminates the respondent’s option to receive a paper check for such payments. Items 10a, 10b, and 10c, which collect the claimant’s bank routing number, type of account (checking or savings), and their account number remain unchanged. TTB also is revising the instruction for Item 10 to state that the respondent must enter their direct deposit information when filing a claim seeking payment from TTB. The instructions for Items 10a, 10b, and 10c remain the same as on the previous edition of the form but, for clarity, TTB has placed the figure showing the location of bank routing and account number on a check after the instructions for Item 10c rather than before that instruction.

TTB believes that these minor changes to Item 10 and the related instructions on TTB F 5620.8 made in response to E.O. 14247 do not affect this information collection’s per-respondent or total annual burden. The only changes to the form are the revision of the parenthetical note in Item 10 and revision of the instructions for that item. These minor changes do not add any new data fields or new concepts to the form, and they entail no addition to its burden as the direct deposit-related data fields have been displayed on TTB F 5620.8 for some time. As such, TTB believes that the changes to this information collection are non-substantive in nature, and we request OMB approval of the described changes to this information collection on that basis.

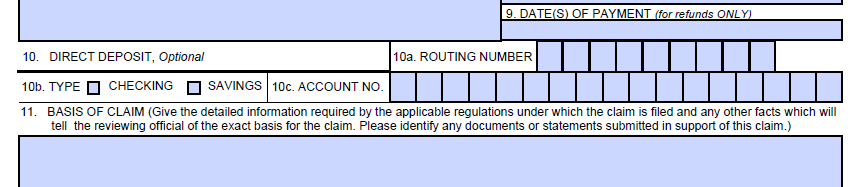

The figures below show the previous version of Item 10 and its instructions on TTB F 5620.8, which allowed the respondent to provide direct deposit information as an option for the payment of drawback or refund of tax:

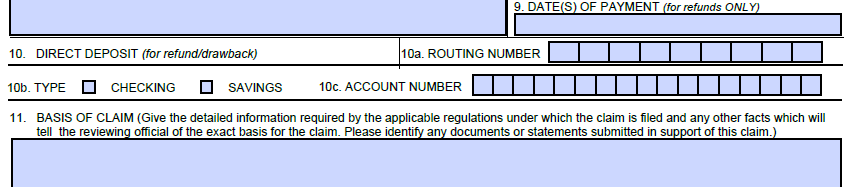

The figures below show the new version of Item 10 and its instructions on TTB F 5620.8, which now allows only for direct deposit of payments from TTB for drawback or refund of excise taxes that it collects:

[END]

1 The types of claims made using TTB F 5620.8 include: Remission of Tax, Allowance of Loss, Drawback–Manufacturer of Non-beverage Products, Allowance of Credit for Tax, and Allowance of Drawback–Export. “Drawback” is the refund of a collected or determined tax.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy